When it’s time to prepare tax forms like 1099 and 1096, many QuickBooks Desktop users find themselves facing printing issues that can delay year-end reporting. If you’re asking, “Why can’t I print 1099 or 1096 in QuickBooks Desktop?”, you’re not alone. These problems are common during the tax filing season and can stem from several technical or configuration-related issues.

In this comprehensive guide, we’ll explore the main causes behind this problem and show you how to successfully print Form 1099 and 1096 in QuickBooks Desktop.

For immediate assistance, you can reach out to certified experts at +1(866)500-0076 for step-by-step help.

Understanding Forms 1099 and 1096 in QuickBooks Desktop

Before diving into troubleshooting, let’s briefly review what these forms do:

Form 1099-NEC/MISC: Used to report payments made to independent contractors or non-employees during the tax year.

Form 1096: A summary transmittal form that accompanies paper-filed 1099s when submitted to the IRS.

QuickBooks Desktop simplifies generating and filing these forms. However, when you can’t print form 1099 and 1096 in QuickBooks Desktop, it usually points to setup issues, printer problems, or outdated software.

Common Reasons You Can’t Print 1099 or 1096 in QuickBooks Desktop

1. Outdated QuickBooks Desktop Version

One of the top reasons is using an older version of QuickBooks Desktop. IRS form layouts and compliance rules change annually. If your software isn’t updated, it may not align with the latest form designs, resulting in print alignment errors or missing fields.

Solution:

Go to Help → Update QuickBooks Desktop → Update Now.

Install all updates and restart your software.

Try printing again.

Keeping your software current ensures compatibility with new IRS formatting.

2. Incorrect Vendor Setup

Another common cause is incomplete or incorrect vendor information. QuickBooks requires vendors to be marked as eligible for 1099 reporting.

Solution:

Open Vendors → Vendor Center.

Select the vendor and click Edit Vendor.

Go to the Tax Settings tab and check Track payments for 1099.

Ensure you’ve entered a valid Tax ID (TIN or SSN).

This ensures the system properly includes the vendor when generating and printing your forms.

3. Misaligned or Improperly Loaded Preprinted Forms

If you’re using preprinted IRS-approved forms, even slight misalignment in the printer can cause printing errors.

Solution:

Print a sample alignment test in QuickBooks before printing real forms.

Go to File → Print Forms → 1099s/1096s → Print Sample.

Adjust the alignment settings as needed.

Ensure your printer is set to “Actual Size” or “100%” and not “Fit to Page.”

4. Incompatible Printer or Printer Driver Issues

Sometimes, QuickBooks cannot communicate correctly with the printer, especially if you recently updated Windows or switched devices.

Solution:

Ensure your printer is set as Default Printer in Windows.

Update your printer driver from the manufacturer’s website.

Try printing a test page outside QuickBooks.

If successful, reopen QuickBooks and print your forms again.

If your printer still doesn’t respond, you can try using QuickBooks Tool Hub to fix printing issues.

5. Mapping Errors in 1099 Preferences

Incorrect mapping between QuickBooks accounts and 1099 boxes can cause your forms not to generate or print properly.

Solution:

Go to Edit → Preferences → Tax: 1099 → Company Preferences.

Click Map Accounts.

Ensure that all relevant expense accounts (e.g., “Contractor Payments”) are mapped to the appropriate 1099 boxes.

Click Save & Close when done.

This step ensures accurate reporting and printing of 1099 information.

6. Damaged QuickBooks Company File

Corruption in your QuickBooks company file can lead to missing vendor data or form generation issues.

Solution:

Run the Verify Data tool:

Go to File → Utilities → Verify Data.

If errors are found, use Rebuild Data to repair them.

Alternatively, you can restore a recent backup file and check if you can now print the 1099 and 1096 forms.

7. PDF or Printer Component Issues

QuickBooks uses internal PDF and printer components. If these are damaged or outdated, printing will fail.

Solution:

Use QuickBooks Print & PDF Repair Tool within QuickBooks Tool Hub:

Download and install QuickBooks Tool Hub (latest version).

Open it and choose Program Problems → QuickBooks PDF & Print Repair Tool.

Once complete, restart QuickBooks and try printing your forms again.

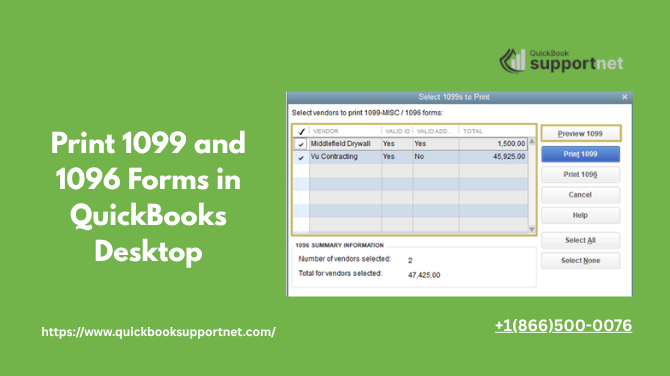

How to Properly Print Form 1099 and 1096 in QuickBooks Desktop

Once all setup and troubleshooting steps are complete, follow these instructions to correctly print your tax forms:

Go to File → Print Forms → 1099s/1096s.

Choose the 1099 form type (NEC or MISC) and select the tax year.

Review vendor data and confirm the amounts.

Choose Print 1099s or Print 1096.

Select your printer and paper type (preprinted or blank).

Print a test sample to verify alignment.

When satisfied, print the final forms for submission.

If you’re using blank paper, ensure that the form layout on-screen matches the IRS-approved format.

Additional Tips for Smooth 1099/1096 Printing

Use IRS-Approved Forms: Always purchase compatible 1099 and 1096 forms to avoid formatting issues.

Keep Vendor Records Updated: Maintain current addresses and tax IDs.

Back Up Your Company File: Before making major changes, create a backup copy.

Check System Permissions: Ensure you have admin rights in both Windows and QuickBooks.

When to Contact a Professional

If you’ve tried all the above steps but still can’t print Form 1099 and 1096 in QuickBooks Desktop, it may be time to seek expert help. Problems like deep file corruption, printer driver conflicts, or complex network configurations often require technical assistance.

You can contact QuickBooks Desktop Support at +1(866)500-0076 for prompt guidance from certified professionals. They can remotely diagnose and resolve your issue efficiently.

Conclusion

Printing your 1099 and 1096 forms in QuickBooks Desktop should be a straightforward process once your software, printer, and form settings are properly configured. Most issues occur due to outdated software, incorrect vendor mapping, or printer alignment errors — all of which can be easily fixed by following the solutions in this guide.

If you still face challenges, don’t let printing delays affect your tax filing deadlines. Visit QuickBooksupportnet or call +1(866)500-0076 to get professional support for any QuickBooks Desktop issues, including form printing, alignment, and vendor setup.

With the right approach and expert guidance, you can easily print Form 1099 and 1096 in QuickBooks Desktop and ensure your tax season goes smoothly.

Write a comment ...